Focus on Value Creation

Summary: Today’s innovative performance is generally poor, but it can be greatly improved. Entrepreneurship is the driving force of an innovative economy, but most professionals are value creators, not entrepreneurs. The initial stages of value creation are where much of the failure resides. More effort must be placed on the core concepts and processes of effective value creation, which is the precursor to all major innovations. Value creation is a discipline that can be learned and applied. It is a discipline that all professionals, and all would be entrepreneurs, should master. Doing so would have a large positive impact on America’s growth and the creation of additional meaningful jobs.

Value creation, innovation, and entrepreneurship are essential elements of a growing, prosperous economy. Carl Schramm, former president of the Kauffman Foundation, pointed out that since 1980 we have created almost 300 university Innovation and Entrepreneurship (I&E) programs, 1,600 startup incubators, and each year the government now spends billions of dollars on I&E programs, like SBIR grants and public venture funds. The people who run these programs all say they are a tremendous success, and a few are.

But all this effort has not visibly improved either the number or success rate of new ventures across America. In 1980 the U.S. created 700,000 new ventures but in 2016 the number was down to 400,000. Clearly a host of different factors drive the economy and the formation of new ventures, but it is hard to argue that this huge I&E investment has made the difference promised.

I addressed this issue recently at the National Academy meeting called GUIRR (Government, University, Industry Research Roundtable). My keynote was “Innovation for Impact,” which you can watch here. My slides are here (C Carlson).

Are we working on the right problem? The lack of improvement in venture formation suggests that these I&E programs may not be focused on the real problem. All new ventures are important, including “mom and pops”, but what moves the economic dial are ventures that scale in size and employment. They are often enabled by major advances in R&D, such as CRISPR/Cas9 and entropy encoding, which enable important innovations of global scale. In addition, these global advances are increasingly the result of technology and market convergence, such as demonstrated by Siri. That requires the comprehensive use of value-creation best practices, as documented here by the National Academy of Engineering. In my talk I highlighted issues that are limiting our performance along with concepts and practices to improve our impact.

Most professionals are value creators, not entrepreneurs. Jim Clifton, CEO of the Gallup Corporation, suggests that less than 0.5% of the population have the attributes to be entrepreneurs. No doubt, the number who can create companies of scale is much, much smaller. There are less than 20,00 large companies (i.e., >500 employees) in the U.S. out of a population of 325 million. Most professionals will work for a company, a university, or the government. Few will be entrepreneurs, but all should be value creators. Our experience creating dozens of major new products around the world, plus our workshops with over a hundred big and small companies, government agencies, and startups, demonstrates that remarkably few professionals are knowledgeable value creators.

The innovative failures we see are overwhelmingly at the start of the value-creation process. Value creation precedes innovation and entrepreneurship. Knowing how to fill out 12 venture slides does not address the issue of creating significant new customer and market value. Many enterprise R&D and innovation efforts could be 2 to 10 times more productive. For example, when I joined SRI International as CEO, it had been failing for almost 20 years. By implementing fundamental value-creation practices, revenue grew 3.5 times and tens of billions of dollars of new marketplace value was created, as described in our book, Innovation and in If You Reallly Want to Change the World and in The Age of Agile.

Entrepreneurial courses and methodologies are generally ineffective at creating significant new customer value. Indeed, I&E programs can create confusion by being initially too complex and, at the same time, lacking essential concepts. Value creation is hard. It is the result of intense learning, searching, and creating. It requires finding faint signals in a sea of constantly changing noise. All our experience shows that complex methodologies do not work. Introducing complexity in the value-creation process with the wrong methodology is counterproductive.

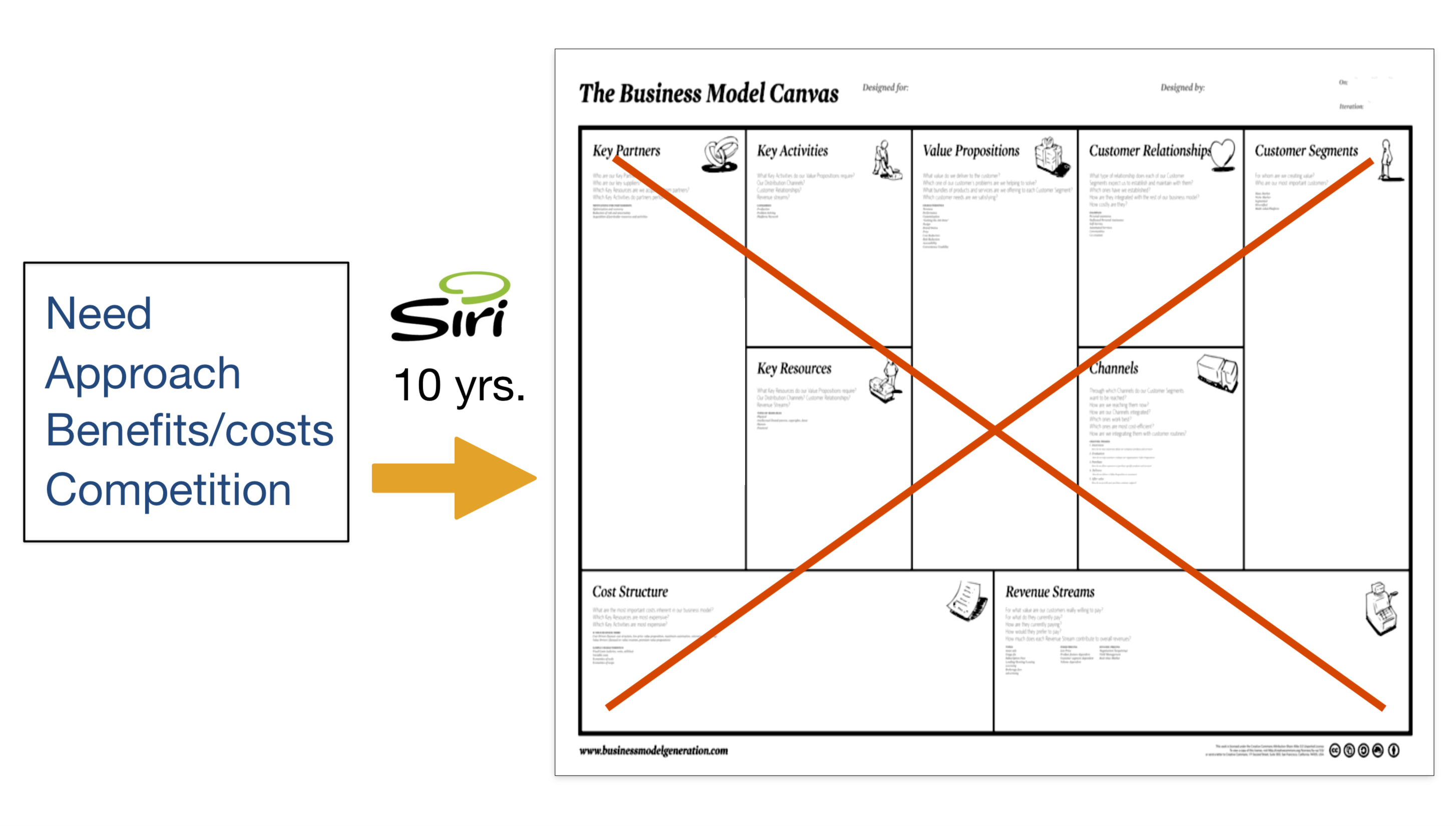

For example, a popular concept is the “business model canvas,” shown below and in my talk as slide #24. My first reaction when I saw it was that, although I have helped create over two dozen new ventures and products, including HDTV and Siri, I never created a chart that looked remotely like that! At some point, variations of these topics must be addressed, but usually after years of effort and only after the core working hypothesis for the proposed business is firmly understood. As I discuss in the talk, the business model canvas and its many alternatives lack: 1) a focus on identifying important opportunities, 2) a useful definition for the value proposition, and 3) a way for teams to rapidly improve through comparative learning.

DARPA uses the Heilmeier Criteria, which is a simpler and better value creation framework than the canvas. Ultimately, in some form, all of its nine questions must be answered. But it is still not concise or fundamental enough. I was on the GM SAB with George Heilmeier for many years and he agreed that the use of NABC value propositions was a better starting point for creating new innovations. He said his criteria were hard for people to understand and that almost no one could remember them. As a result, there seemed to be a hundred versions of the “Heilmeier Criteria.” True, just ask someone to try and repeat them.

Value creation begins by addressing the few, most basic concepts first, as summarized in an NABC value proposition. The four NABC ingredients are the minimal, interconnected set of questions that must be answered. If a team cannot reasonabily answer those four questions then they haven’t figured out yet what they are doing. Over time other elements of a plan are added as risk is removed. In our workshops, without exception, all teams have struggled to initially answer those questions. Most discover that they do not fully understand their core issues, and a surprisingly large percentage learn that what they are working on has no value for their enterprises.

In a large, international company, the 6 teams in the workshop discovered that none of their projects had any real value for their enterprise. They decided this, we just give them the framework to come to that realization. Because we have seen similiar results repeately in all kinds of enterprises, we are convinced that great improvements in innovative performance are possible.

1 Comment

Henry kressel

Well stated. Most value creation should occur within existing enterprises. The problem is that few managements know how to encourage or manage innovative employees.